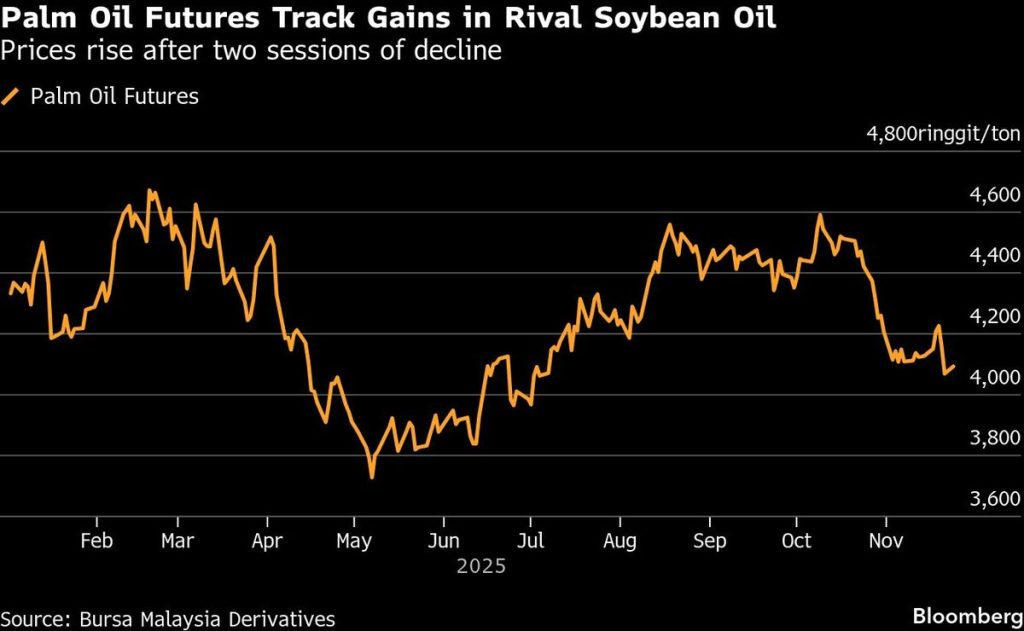

(Nov 24): Palm oil prices climbed after two sessions of decline, on the back of a rise in rival soybean oil.

Soybean oil gained as much as 0.3% after the US Department of Agriculture announced more sales of American soybeans, along with the first known sales of wheat, to China on Friday.

However, market players expect the rise in palm prices to be capped by expectations of growing supply. Malaysia’s October palm oil data shows inventory build-up, which has resulted in overhang, said Budiman Suwardi, head of treasury and markets at Borneo Agri-Resources International. This would be a key fundamental drag in palm oil prices, he added.

Meanwhile, the Malaysian currency remains strong, dimming the appeal of the ringgit-denominated cooking oil for price-sensitive buyers.

Prices

- Palm for February delivery on Bursa Malaysia Derivatives rises as much as 0.7% to RM4,097/tonne

- Palm futures as of midday break stands at RM4,083/tonne; down 8% year to date

- Soybean oil for January in Chicago rises 0.3% to 50.7c/lb

- Refined palm oil for January on Dalian Commodity Exchange is down 0.5% to 8,508 yuan (RM4,957.81)/tonne

- Soybean oil for January little changed at 8,186 yuan/tonne

- Soybean oil’s premium over palm is ~US$133 (RM551.02)/tonne versus an average of ~US$70 in the past year, according to data compiled by Bloomberg

- Palm’s premium over gasoil is ~US$271/tonne versus an average of ~US$316 in the past year, according to data compiled by Bloomberg

Source: The Edge Malaysia