1. Introduction

Libya’s palm oil market demonstrates a clear upward trajectory, fueled by escalating demands within its vital food manufacturing and consumer sectors. The data reveals a significant surge in palm oil product imports from 2020 to 2024, with cooking oil exhibiting particularly robust growth. This trend underscores palm oil’s role in the Libyan culinary landscape and its broader economy. Despite potential challenges posed by the region’s political complexities, the expanding demand presents compelling opportunities for palm oil exporting nations, notably Malaysia, to capitalize on this burgeoning market. With demand increasing across various food manufacturing sectors, palm oil plays an important role in Libya’s economic and culinary landscape.

2. Libya’s Economic and Food Industry Outlook

Libya’s food industry is dynamic, experiencing notable growth driven by demographic, economic, and governmental factors. Demographically, while Libya’s population is estimated at 7 million, the presence of approximately 4 million expatriate workers, primarily from Egypt, significantly expands the consumer base and diversifies dietary habits and preferences. This diverse demographic profile fuels demand for a wider variety of food products, many of which utilize palm oil. Rising disposable incomes and rapid urbanization increase demand for foods items, creating opportunities for palm oil in applications such as ready-to-eat meals, snacks, and baked goods. Furthermore, the Libyan government is actively promoting the development of the food manufacturing sector. A significant example is the Prime Minister’s December 2024 approval of the National Food Security Strategy 2025-2035. This ambitious plan encompasses 174 projects and 65 programs to bolster local production, achieve self-sufficiency, and establish a sustainable food system. The strategy emphasizes collaboration between the government and private sectors to address challenges and unlock the sector’s potential. Indeed, the private sector has been a pivotal force in the industry’s recent growth, demonstrating its dynamism and responsiveness to evolving consumer demands.

3. Libya’s Oils and Fats Market

Libya’s edible oils and fats market significantly depends on imports, creating considerable challenges. Total consumption of oils and fats is estimated at 215,000 tonnes, while domestic production is limited to approximately 15,500 tonnes, primarily olive oil. This substantial gap between consumption and domestic production necessitates significant imports to satisfy local demand. The market is characterized by small-scale domestic olive oil producers, a limited number of manufacturers, and a diverse range of importers specializing in various edible oils and fats, with palm oil playing a prominent role.

Palm oil is multifaceted in Libya’s food industry, serving as a crucial and versatile ingredient. Its high heat stability, affordability, and neutral flavor profile make palm olein the preferred choice for industrial frying applications. Palm oil’s unique fat composition makes it suitable for margarine manufacturing, providing the desired texture and spreadability. In the confectionery sector, palm oil and its fractions are utilized in various products, including chocolates, candies, and biscuits, due to their specific melting properties that create a smooth mouthfeel and desirable texture. Palm oil also plays a role in bakery products like cakes and pastries, improving texture, shelf life, and overall product quality. Beyond these traditional applications, palm oil is also used to produce vegetable-based cheese, further demonstrating its versatility and expanding its role within the Libyan food sector.

The country imports approximately 58,000 tonnes of palm oil annually, representing a significant portion (29%) of its total oil imports. A positive trend is the substantial growth of Malaysian palm oil products exports to Libya, increasing from 1,500 tonnes to around 6,400 tonnes over the past five years, indicating growing acceptance and demand. This quadrupling of MPO exports demonstrates growing acceptance and demand, pointing to promising opportunities for future export growth.

Libyan food manufacturers consistently emphasize the need for a reliable and stable palm oil supply, creating a key opportunity for Malaysian suppliers who can guarantee consistent product quality, timely delivery, and competitive pricing. Product diversification could also provide a competitive edge by offering specialized palm oil products like specific fractions or blends tailored to applications. Furthermore, providing value-added services such as technical support, formulation assistance, or customized packaging solutions could enhance the value proposition for Libyan food manufacturers.

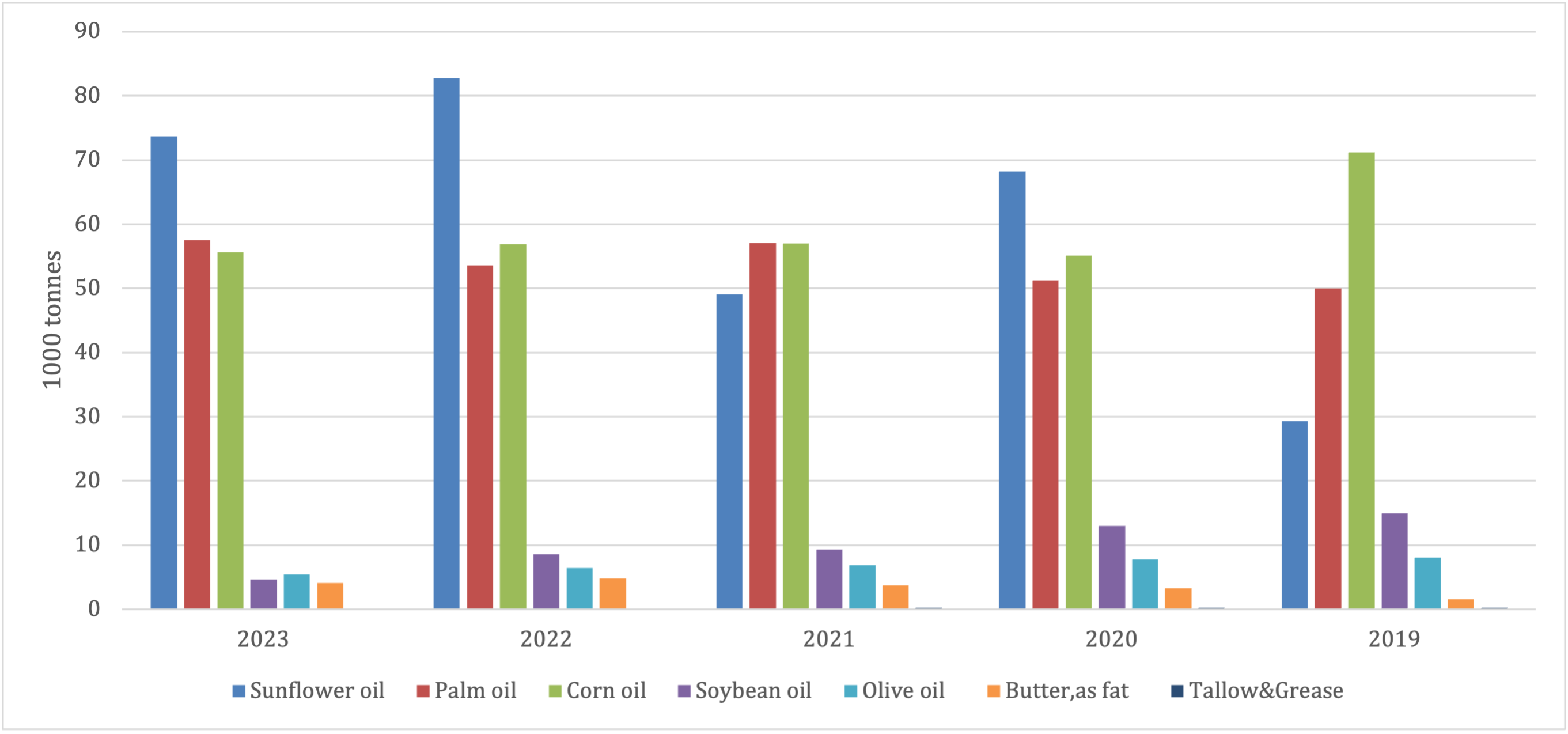

Imports of Major Edible Oils (2019-2023)

4. Government Import Tariffs Favoring Palm Oil

Libya’s 2022 import tariff policy provides full exemption from import duties on a wide range of crude and refined vegetable oils, including palm oil, palm kernel oil, soybean oil, sunflower oil, and corn oil. This pro-import approach significantly lowers the cost of essential raw materials for Libyan food manufacturers, making vegetable oils more accessible and affordable for industrial use. As a result, the policy supports the growth of the domestic food manufacturing sector by reducing production costs, improving margins, and enhancing overall competitiveness. The tariff exemption not only benefits importers but also helps ensure price stability in the local market, contributing to food affordability for Libyan consumers. By eliminating duties on these widely used oils, the government demonstrates its commitment to supporting the national food supply chain and mitigating the impact of global price volatility on essential commodities.

5. Strategic Considerations for Expanding Malaysian Palm Oil in Libya

As Libya’s food sector evolves, there is growing demand for food products that incorporate palm oil. Understanding local consumer preferences will be key to aligning product offerings with market needs. Strengthening engagement with key stakeholders—including business leaders, government officials, and food manufacturers—can support deeper market penetration and long-term partnerships.

Prepared by Lamyaa El Enany

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.